If you re unimpressed or dissatisfied with the investment choices available in your retirement plan check to see if a self directed 401 k is available.

Self directed brokerage window 401k.

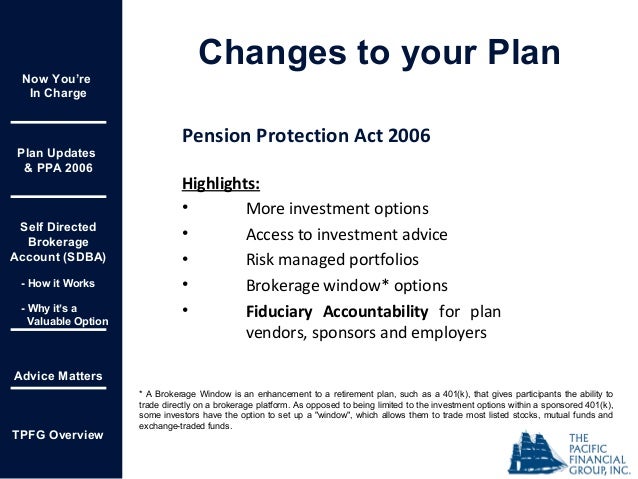

The self directed brokerage account gives investors access to a wider range of investment choices than the default ones presented in the plan.

These days there are some conflicting trends circulating in the 401 k marketplace.

The self directed brokerage window is increasingly opening up as an option for 401 k plan participants.

While the plan s menu may be limited to 10 to 25 investment alternatives depending on the particular plan for this purpose counting a target date fund suite as a single alternative a brokerage window can provide access to several thousand mutual funds as well as depending on the particular arrangement the ability.

The fidelity 401k brokeragelink fidelity s version of a self directed 401k within a managed 401k account is one of the best brokerage windows offered on the market today.

Adding a self directed brokerage window to your 401 k is a brokerage window also known as a self directed option or account a smart option for your company s 401 k plan.

Offering self directed brokerage accounts in a 401k plan is a bad bet 401k plans with self directed brokerage accounts that allows participants to choose almost any type of investment is another form of gambling and a plan sponsor may unknowingly expose themselves to liability by offering this feature.

It lets retirement investors break out of the curated investment options in their.

As more people become sensitive to investing fees some employers are now offering 401k accounts with a brokerage window.

Yes that includes stocks etfs bonds and even some lower risk trading.

Many participant directed 401 k plans these days include a self directed brokerage window option as a way to supplement the plan s menu of designated investment options.

While the plan s menu may be limited to 10 25 investment alternatives depending on the particular plan for this purpose counting a target date fund suite as a single alternative a brokerage window can provide access to several thousand mutual funds as well as depending on the particular.

When you contrast a self directed brokerage account to a traditional retirement account like a 401 k the difference becomes quite clear.

This alternative has raised many eyebrows in fiduciary circles as it allows investors to take much.

A brokerage window allows you to take advantage of the many other investment options outside of a normal 401k.

Most 401 k s only offer a limited selection of mutual.

:max_bytes(150000):strip_icc()/investing_122406243-5bfc372ac9e77c00263343e3.jpg)

:max_bytes(150000):strip_icc()/shutterstock_273234314-5bfc3b8646e0fb002605a623.jpg)

:max_bytes(150000):strip_icc()/istock150684235.businessman.executor.black.cropped-5bfc328146e0fb0083c1bde3.jpg)